Low Code App Suite For Insurance Companies

Underwriting

Deploy & iterate your Underwriter Workbench Template as fast as your organization demands.

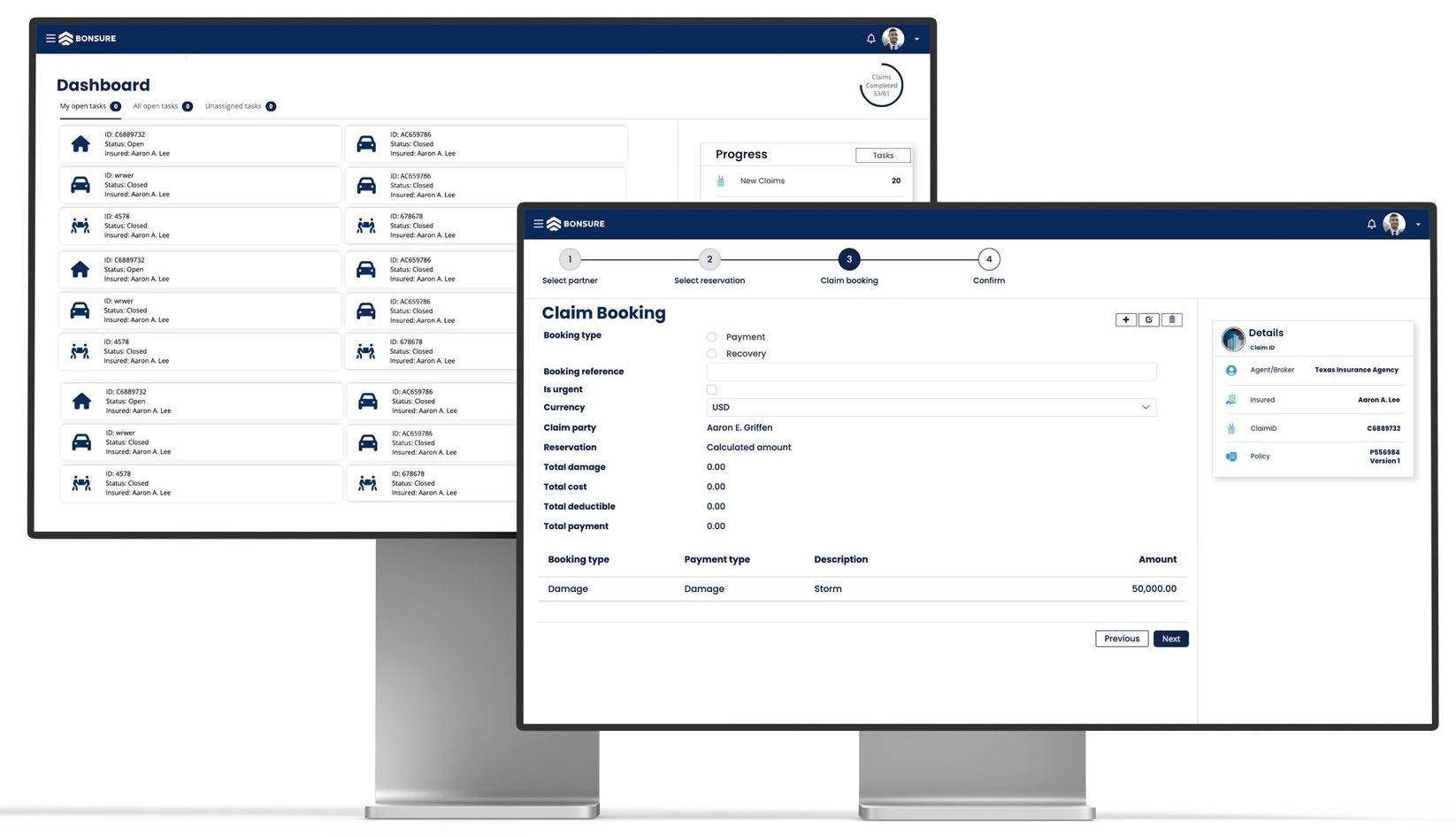

Claims

Kickstart your Project with the Claims Portal Template and leverage the seamless integration options.

Agents

Improve Broker Satisfaction, Retain and Attract Customers with our White Label Broker Portal.

Quote & Buy

Accelerate your Quote & Buy capabilities and connect to your core insurance applications.

WHAT WE DO

Supercharge Your Insurance Business

Boost your insurance business with Bonjoy’s Solution Templates and digital capabilities. Empower your customers, agents, brokers, and employees with innovative solutions for underwriting, claim handling, and quote and buy.

- Prioritize the features your customers need

- Align everyone around the roadmap

- Define your product vision with customer feedback

DEVELOPING FRAMEWORK

Future-ready Insurance Operations

Drive Sustainable Growth

By implementing the new product launch strategy, we can increase speed to market by up to 60%. Additionally, by incorporating automation into our back office processes, we can expect to increase productivity by 15-20%.

Redefine Customer Experience

By creating personalized and digital customer interactions, you can unlock customer value through data-driven insights. You can also shift up to 40% of transactions to self-service, improving efficiency and the customer experience.

Accelerate Innovation

By combining intelligent technologies and insurance talent with next-generation skills, we can scale our vision for the future. By using the right resources at the right time, we can improve our decision making and stay ahead of the curve.

BONSURE

Business Drivers

Increase Policy Profitability

Insurance companies are embracing digital strategies to drive growth and improve profitability. Bonjoy offers templates for digital engagement solutions, increasing customer upsell and cross-sell opportunities and improving user experience. These innovations generate new revenue sources and improve agent share of wallet and customer satisfaction.

Combined Ratio

Tired of high operating costs and sluggish revenue growth? Streamline your operations with Bonjoy. We can digitize and optimize your operations, lowering support costs and speeding up processing times. Our industry templates help you quickly build towards "zero-touch" processes, boosting efficiency and driving revenue. Don't let manual tasks and resource-intensive processes hold you back. Let Bonjoy help your business thrive.

Regulations

Want to quickly comply with new regulations? Bonjoy can customize your workflows and UI in hours. Our insurance templates offer added security and risk management to meet compliance standards. Our scalable platform approach allows our solution to grow with your business, so you can focus on your customers' needs.

Reduce IT Debt

Is a large portion of your IT budget going towards maintaining legacy systems? Modernizing them can drive growth and improve efficiency, but can be complex. Bonjoy offers tools to redesign and modernize systems faster. Our solutions allow for phased migration or can act as a wrapper for existing systems. Consolidate core systems and data sources with our open API framework to improve data transparency and employee responsiveness to customer needs.