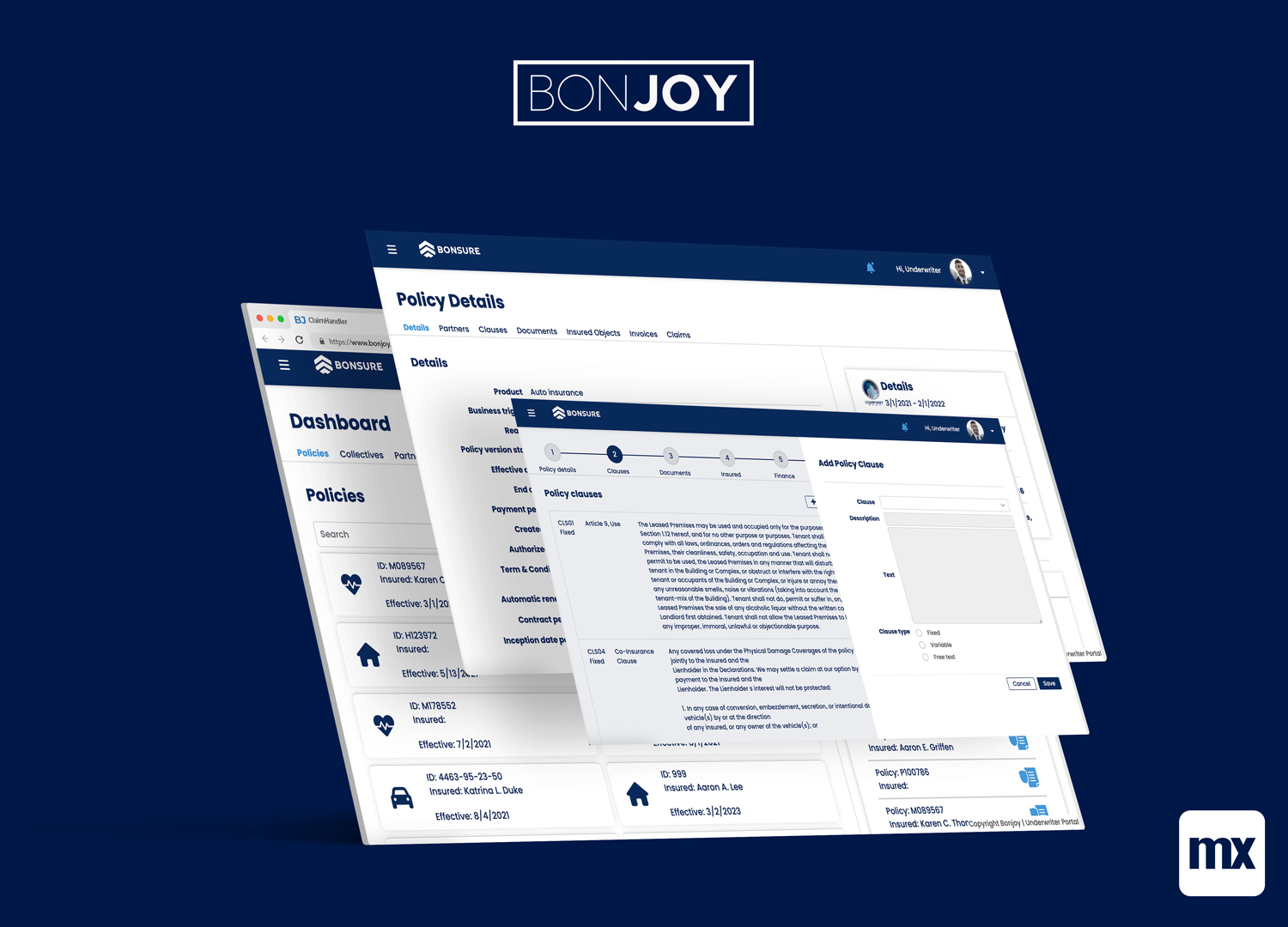

Bonsure Insurance Suite

Four separate insurance applications that work independently or together. Choose individual apps or deploy the complete suite for total insurance digital transformation.

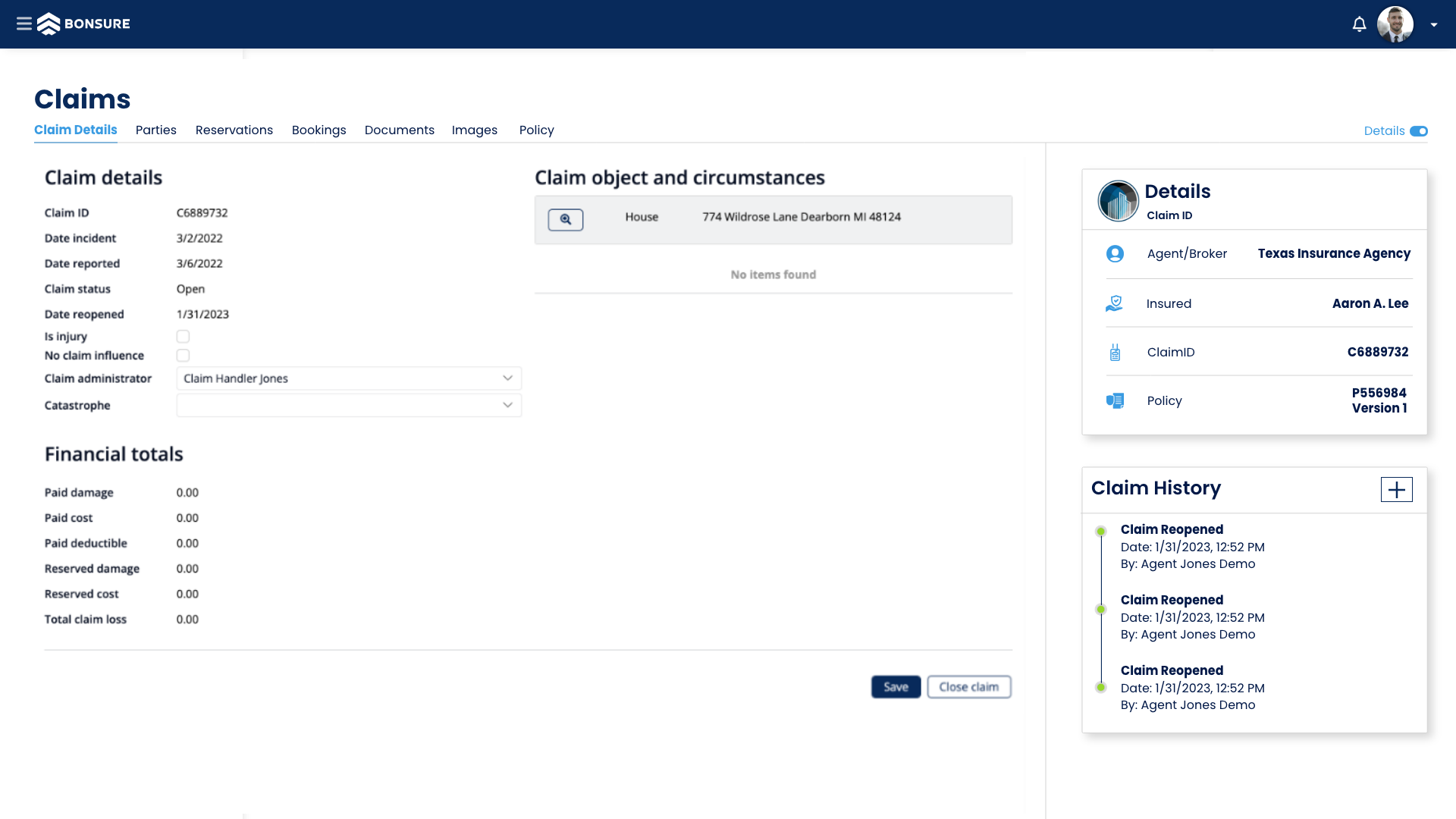

Claim Handler

Claims processing with automation and fraud detection

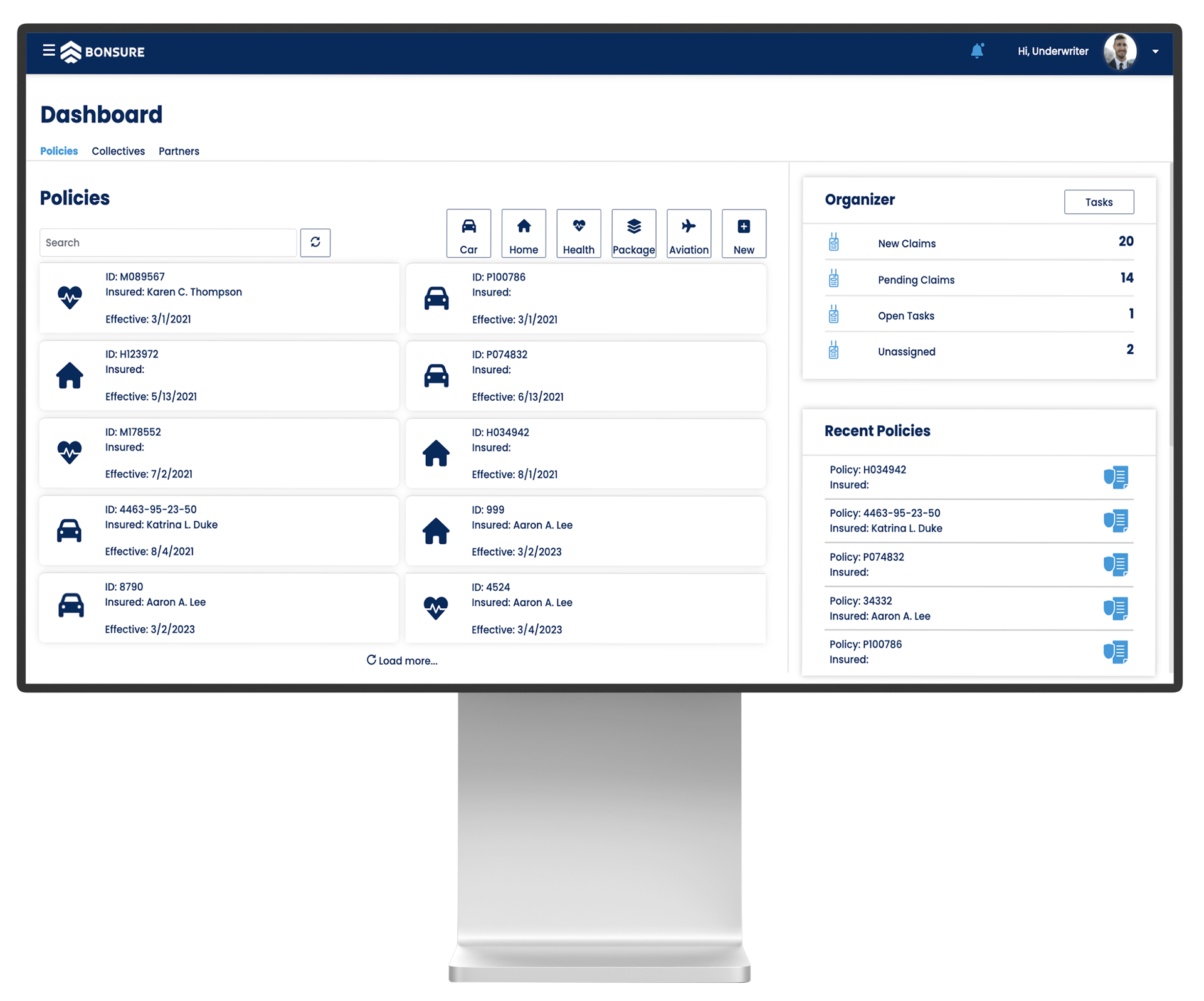

Underwriter Portal

Complete underwriting platform with risk assessment and policy management

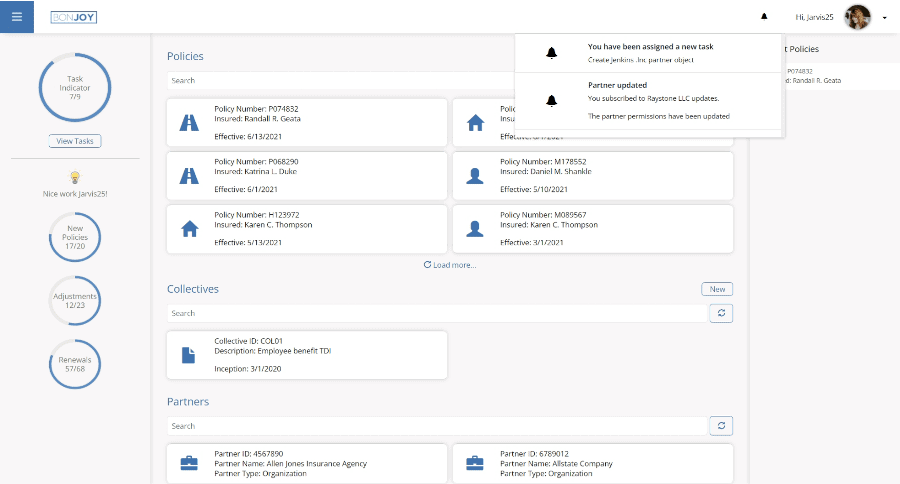

Agent Portal

Agent management for insurance operations

Quote & Buy

Quote generation and policy purchase system

Future-Ready Insurance Operations

Drive Sustainable Growth

Increase speed to market by 60% with automated product launches. Boost back office productivity by 15-20% through process automation.

Redefine Customer Experience

Create personalized digital interactions with data-driven insights. Shift 40% of transactions to self-service, improving efficiency and customer satisfaction.

Accelerate Innovation

Combine intelligent technologies with modern insurance expertise. Use the right resources at the right time to improve decision making and stay competitive.

Business Drivers

Increase Policy Profitability

Drive growth with digital engagement templates that increase customer upsell opportunities and improve user experience. Generate new revenue sources while boosting agent retention rates.

Combined Ratio

Lower operating costs and speed up processing with digitized operations. Our templates help build "zero-touch" processes, boosting efficiency and driving revenue.

Regulations

Quickly comply with new regulations through customizable workflows. Our templates include built-in security and risk management to meet compliance standards.

Reduce IT Debt

Modernize legacy systems faster with our redesign tools. Enable phased migration or wrapper solutions. Consolidate systems with our open API framework for improved data transparency.

Four Separate Insurance Apps

Deploy apps individually or combine for complete operations.

Claim Handler

Claims processing with automation and fraud detection

Underwriter Portal

Complete underwriting platform with risk assessment and policy management

Agent Portal

Agent management for insurance operations

Quote & Buy

Quote generation and policy purchase system

Built for Insurance Operations

Our proven methodology transforms insurance operations with minimal business disruption through customizable templates and integrated workflows.

Discovery & Analysis

Complete analysis of existing workflows, systems, and regulatory requirements.

Template Customization

Adapt the four Bonsure modules to your specific business requirements.

Integration & Deployment

Direct integration with existing systems and gradual rollout.

Training & Support

Complete training for all stakeholders and ongoing support.

Agent Portal Features

See Our Insurance Solutions in Action

Watch detailed demonstrations of our Underwriter Portal and Claims Handler applications. See exactly how these solutions streamline insurance operations.

Complete Insurance Development Solutions

Full-stack enterprise development services to build, integrate, and deploy your insurance digital solutions.

Bonsure Insurance Suite

Complete insurance operations platform with 4 integrated modules

Custom Applications

Enterprise applications tailored to your insurance processes

Low-Code Development

Rapid development and deployment with visual tools

AI Solutions

Smart insurance with predictive analytics and automation

System Integration Services

Connect your existing insurance systems with modern APIs and workflows

Your Path to Insurance Digital Transformation

A tested methodology that transforms your insurance operations with minimal disruption to business.

1. Insurance Assessment

We analyze your current insurance processes, claims workflows, and pain points to identify optimization opportunities and bottlenecks. Then we create a clear roadmap that aligns with your business goals.

Key Outcomes

2. Solution Design

We design the system architecture and user experience specifically for your insurance environment and business needs. This includes detailed technical specifications and a step-by-step implementation plan.

Key Outcomes

3. Development & Testing

We build your solution using established development methods with continuous testing. Every component is tested thoroughly in staging environments to ensure reliability and performance.

Key Outcomes

4. Deployment & Training

We deploy your solution with zero impact to business operations. Our training programs ensure your insurance team knows exactly how to use the new system directly.

Key Outcomes

Ready to Get Started?

Schedule a consultation to discuss your specific requirements and timeline.

Schedule ConsultationCommon Questions About Our Finance Solutions

Get answers to frequently asked questions about our finance solutions.

We design systems that integrate seamlessly with core insurance platforms, like policy admin systems (PAS), CRM, claims, and rating engines. Whether you’re a carrier, MGA, or independent agency, our solutions complement your existing infrastructure while accelerating your modernization roadmap through APIs, low-code platforms, and cloud-native architectures.

Our work supports key digital priorities: improving customer engagement, automating underwriting and claims workflows, reducing manual processing, and enabling real-time insights. We tailor solutions to align with your strategic objectives,whether that’s speed to quote, omnichannel servicing, risk modeling, or regulatory agility.

We specialize in hybrid integration. Many insurers still rely on legacy core systems, so we build middleware, APIs, and event-based data pipelines that connect those systems with new digital channels, mobile apps, and third-party data providers, delivering modern functionality without needing full replacement.

We lay the foundation by digitizing processes, integrating siloed data sources, and structuring your data for analytics. From there, we implement models for use cases like fraud detection, intelligent document processing (IDP), automated triage, and risk scoring, helping insurers move from reactive to predictive operations.

Yes. We serve both enterprise insurers and smaller agencies or broker networks. For carriers, we modernize core platforms and improve operational efficiency. For agents, we deliver mobile-ready, customer-facing tools and integrations with quoting platforms or CRMs, making day-to-day work faster, simpler, and more accurate.

We enable self-service portals, digital onboarding, e-signatures, and real-time status updates for claims and policies. For agents, we provide smart workflows and mobile tools to access quotes, policy data, and customer interactions in one place, improving satisfaction and retention across channels.

Absolutely. We streamline underwriting with digital forms, risk data integration (e.g., geospatial, credit, driving behavior), and rule-based engines. This reduces back-and-forth, speeds up approvals, and improves quote accuracy, especially in personal, commercial, and specialty lines.

Yes. We help automate claims intake, document capture, and adjuster workflows. Our systems also integrate with fraud detection tools, third-party data (e.g., FNOL providers), and analytics platforms, enabling faster decisions, fewer errors, and reduced claims leakage.

We build auditable systems that track data lineage, enforce regulatory workflows, and maintain detailed logs for governance. Whether you need to support regional insurance regulations, GDPR, SOC 2, or other standards, our solutions are built with compliance by design.

We take a phased and collaborative approach, working closely with IT, operations, and compliance teams. Our methodology includes sandbox testing, pilot deployments, change management support, and full training materials, ensuring your teams are prepared, your workflows are protected, and your customers experience zero downtime.

Ready for Your Insurance Solution?

Discover how our proven insurance platforms can streamline your operations and accelerate your digital transformation.